So how to check out who is really innovating and whether they are actually generating any tangible value. A rough measure of innovation intensity can be gained from surveying the web news. Pick a company and then, using Google’s News Archive Search, measure how many web articles mention their name and in turn how many of those same articles include the word “innovation”. It’s crude and simple but seems to pass the sanity check and the ratio does yield an independent measure that at least approximates a company’s “innovation profile”. I know there are many uncontrolled variables and it certainly doesn’t have the rigor of professional research but its “satisficing”.

Based on some background experience plus a few areas of personal business interest I picked 100 listed companies. I limited the survey to 2009/10 news articles to keep it current and obviously because I was also searching for the word “innovation” had to stick with English language web sites. Occasionally I found a smaller business that didn’t appear to have published any qualifying news articles and so unfortunately had to exclude them from my sample.

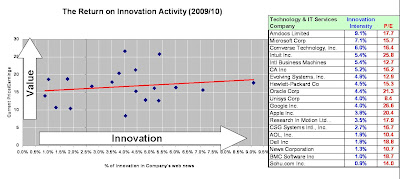

And what did this survey show? The full results will be available from my web site but initially this is a summary of the "top 30" companies in my sample.

- Based on this measure of “Innovation Intensity” (II) there’s a wide range of innovation activity occurring across different companies.

- The average company has 2.5% of their news articles including a reference to “innovation”

- A small group (approx 5% in the total sample) are talking about innovation up to 3 and 4 times more often.

- However there’s also an even larger group (approx 25% in my sample) that don’t appear to be associated with “innovation” much at all.

- The firm conclusion; it’s true not every business is embracing or even interested in innovation but some really are very interested.

So who they are and why?

My simple minded assumption was that company’s innovate (or don’t) because it does (or doesn’t) add value. While product development is certainly fun in itself, I’m still searching for that tier 1 listed company whose primary business goal is just “having fun”.

A useful mantra is that “the success of innovation is ultimately judged by the market”; through things like competitive differentiation, brand reputation and premium pricing. Financial accounting is an industry that’s knee deep in metrics quantifying the market valuation of a business. So after some thought the metric chosen to quantify the relative value of innovation was the simple P/E ratio. The market is certainly the arbiter of a company’s P/E and Nobel prizes have been won showing these markets are informed and efficient. So, all things being equal, it’s expected that more innovation would help generate higher P/E. While (as ever) all things are never equal, exceptions can become obvious and, after all, I’m only searching for some hope, so even a trend would be useful. To avoid some of the “exceptional market valuations” the stock market creates, my sample of companies was restricted to a mid-range market valuation of 5<>30.

A useful mantra is that “the success of innovation is ultimately judged by the market”; through things like competitive differentiation, brand reputation and premium pricing. Financial accounting is an industry that’s knee deep in metrics quantifying the market valuation of a business. So after some thought the metric chosen to quantify the relative value of innovation was the simple P/E ratio. The market is certainly the arbiter of a company’s P/E and Nobel prizes have been won showing these markets are informed and efficient. So, all things being equal, it’s expected that more innovation would help generate higher P/E. While (as ever) all things are never equal, exceptions can become obvious and, after all, I’m only searching for some hope, so even a trend would be useful. To avoid some of the “exceptional market valuations” the stock market creates, my sample of companies was restricted to a mid-range market valuation of 5<>30.

So what happens if this Innovation Intensity (II) is now correlated against a company’s current P/E? Because the II Index was captured using only 2009/10 news articles there’s an implied assumption that innovation “released” to the market over the past 12months it will influences the current market’s view of a company’s P/E ratio.

And what did the correlation show? Well as expected it showed a range of results but the analysis indicated (with some relief) greater Innovation Intensity (II) is associated with higher company valuations (P/E).

In the Telecoms and Communication services sectors this trend was the most positive:

In the Technology and IT services sector (which often brings much of the technical innovation to the rest of the market) the trend was also positive:

However in some sectors including Consumer Products and Financials the correlation between a company’s Innovation Intensity (II) and its market valuation (P/E) was actually negative. The implication is that more innovation for these company’s may actually erode market value.

Perhaps innovation becomes a distraction or a disruption from the more necessary stability, security and control:

So, what does it all mean? Well with some personal relief it does appear to provide reassurance that new product development is worthwhile, at least in some of the more technology or design based industries. But it’s also a reminder that innovation is not valued by the market in every industry. That’s not to say innovation isn’t important to Banks (for example) but the analysis does suggest any innovation they undertake may be more internal and unseen to the market. The analysis also raises a variety of other questions about trends and profiles to further qualify the insight into innovation.

And the winner? Well in my searching at least I couldn't find any company with a higher Innovation Intensity than Amdocs Limited. Almost 1 item in 10 from their 2009/10 web news references "innovation". Now does that sounds like fun?

I’m interested in feedback and views to help achieve better product development.

I’m interested in feedback and views to help achieve better product development.